ICAM has been present in the US since 2010 with Agostoni Chocolate, a commercial subsidiary

Chocolate by Nature

Our concrete commitment

Today ICAM is one of the very few vertically integrated companies worldwide that can guarantee quality and control of the whole supply chain and it is the world’s leading producer of organic chocolate.

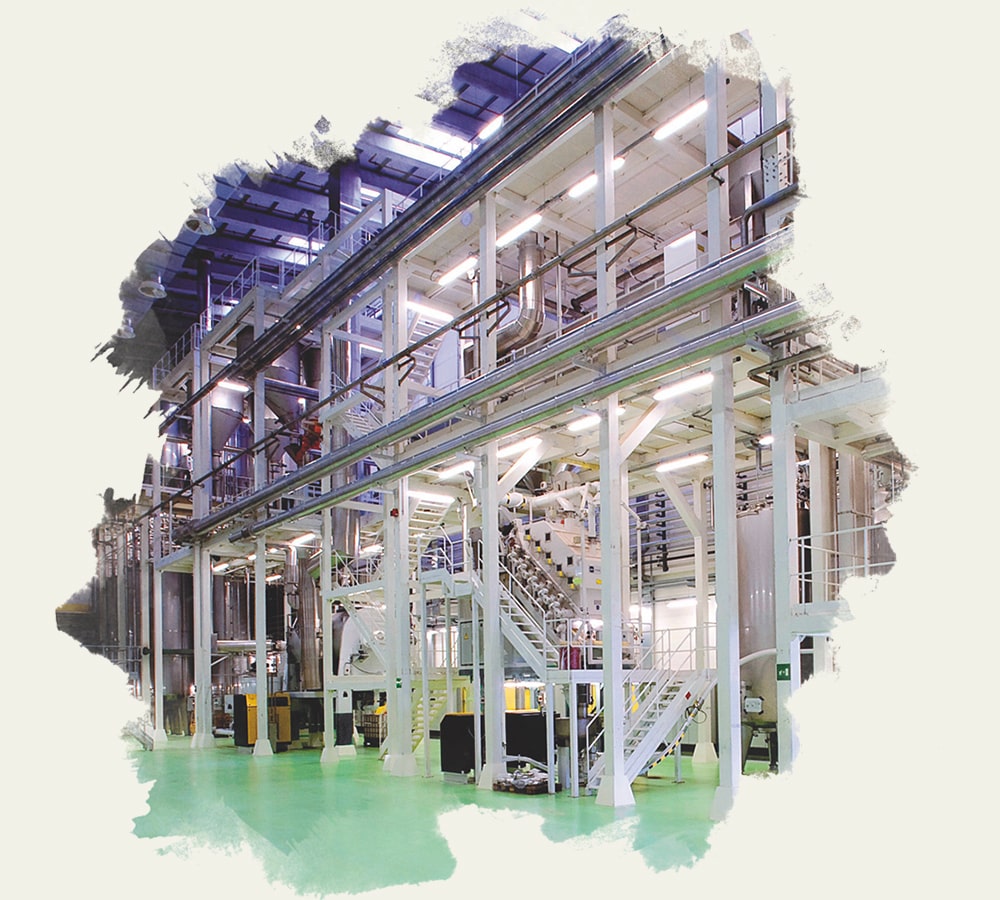

Vertical integration is fundamental to the excellence in quality, manufacturing flexibility and technical competence of the company.

ICAM blends the art of cultivating the intensely flavorful bean with the most advanced processing technologies to create exceptional chocolate, and have been passionately crafting chocolate this way for over six decades.

Sustainability

Since the 1980s, ICAM’s two-fold commitment has involved not only studying and identifying the finest cocoa plantations, but also creating solid, lasting relationships with the self-employed farmers and local communities.

Processing

Agostoni is one of very few companies in the world that can guarantee control of the entire production process. Agostoni follows the best manufacturing practices and adheres to strict regulatory standards including BRC Global Food Safety Standards.

Business area

We aim to meet the needs of three main groups: those who love chocolate, those who work with it, and those who produce it. Our product range is wide, tailored, and constantly evolving. We’ve always explored the best solutions for anticipating trends and successfully fulfilling every request.